Amazon Advertising

Amazon Fees 2025: What Sellers Need to Know About Rising Deal & Promotion Costs

As first outlined by our Director of Advertising Mansour Norouzi in this post, Amazon will begin charging sellers performance-based fees for Lightning Deals, Best Deals, Coupons, and Prime Exclusive Discounts starting June 2, 2025. What used to be flat, predictable costs will now scale with sales volume, making high-performing promotions significantly more expensive.

Learn How to Make Listings That Convert in 2025!

Read our step-by-step guide on how to optimize your listings using Rufus AI insights. Sign up for our newsletter and get your copy for free!

Show me howFor brands that rely on deals to drive sales, this creates a clear tradeoff: higher visibility now comes with higher cost and greater margin pressure. Relying on the same old promotional playbook won’t cut it. Sellers need to reassess where they spend, how they promote, and what actually drives profitable growth on Amazon. This breakdown covers what’s changing, what it means for your margins, and how to protect your bottom line moving forward.

Overview of Amazon Fees 2025

While sellers are already familiar with fulfillment fees (FBA), referral fees, and storage fees, the latest changes impact Lightning Deals, Best Deals, Coupons, and Prime Discounts. This makes promotions potentially much more expensive than before.

Breakdown of Amazon Seller Fees

Amazon’s fee structure consists of several key categories:

- Fulfillment fees (FBA fees) – Charges for picking, packing, and shipping products through Amazon’s fulfillment centers.

- Referral fees – A percentage of each sale paid to Amazon, varying by category.

- Storage fees – Costs associated with keeping inventory in Amazon warehouses, which increase during Q4.

- Promotion fees (New changes in 2025) – The biggest shift, moving from fixed-rate fees to performance-based pricing for deals and coupons.

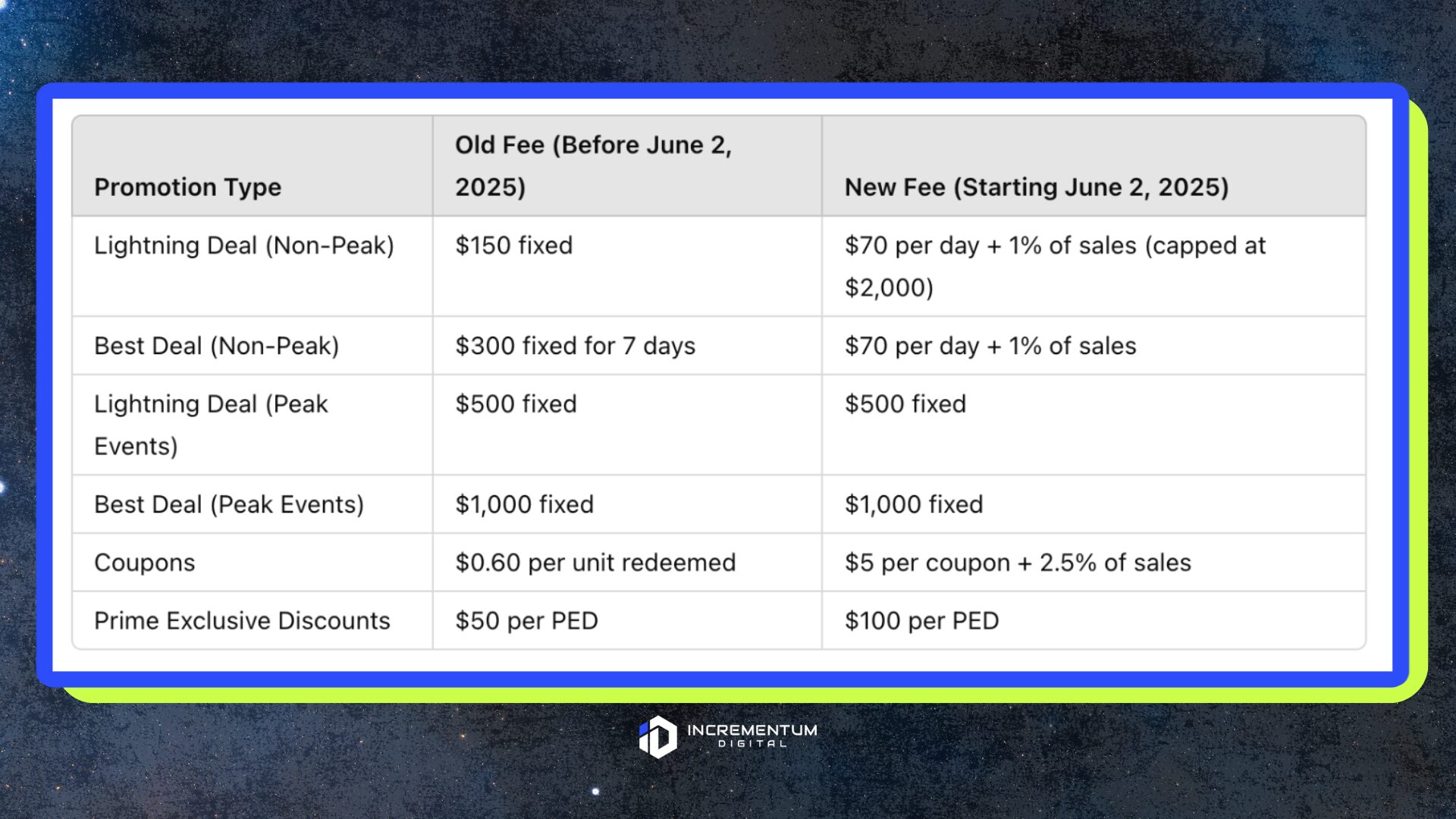

New Deal and Coupon Fees

Previously, Amazon charged sellers a flat fee for promotions, making costs predictable. Starting June 2, fees scale based on sales performance, which could significantly increase costs for high-performing deals. Any deal created after June 2nd will follow the new pricing model, which introduces a daily fee in addition to a percentage of sales. Deals created before this date will still be charged based on the previous flat-fee structure.

For sellers, this means that if a deal performs well, the cost of running it could increase dramatically. The change from fixed fees to percentage-based pricing makes it harder to predict costs, requiring careful budget planning and testing before running large promotions.

How are Deal & Promotion Fees Changing?

Amazon is shifting from fixed fees to a performance-based pricing model for non-peak Lightning Deals, Best Deals, and Coupons. These changes mean that sellers who run successful promotions may see significantly higher costs than before.

- Lightning Deals – Previously a fixed $150 fee, now $70 per day plus 1% of sales, with a maximum fee of $2,000.

- Best Deals – Previously a fixed $300 fee for a seven-day deal, now $70 per day plus 1% of sales, with no cap.

- Coupons – Previously $0.60 per redemption, now $5 flat fee per coupon created, plus 2.5% of total sales from redeemed coupons.

- Prime Exclusive Discounts – The per-PED fee has doubled from $50 to $100.

These changes make deal costs more variable, requiring sellers to carefully plan and test promotions to avoid overspending.

What’s the Impact on Amazon Sellers & Profit Margins?

Before June 2, sellers pay a flat rate for Lightning Deals and Best Deals, allowing them to control costs. Now, fees are tied to sales performance, meaning successful deals could lead to much higher expenses.

1. Unpredictable Pricing

With daily fees plus a percentage of sales, sellers no longer have a fixed cost to plan around. If a deal performs well, costs can quickly escalate, making it harder to forecast profitability. This adds another layer of complexity to budgeting and promotion planning.

2. The Risk of Over-Reliance on Promotions

Brands that rely heavily on discounts and deals to drive sales may face shrinking margins. Since promotions now carry more financial risk, sellers need to be more selective about when and how they run them. Testing shorter campaigns, optimizing pricing strategies, and integrating Amazon advertising can help maintain profitability without overspending on promotions.

3. The Role of Amazon Advertising in 2025

With Amazon’s rising promotion fees, brands need to explore alternative ways to drive conversions while protecting margins. One effective strategy is leveraging Buy With Prime on Shopify, which can help increase sales outside of Amazon while keeping fulfillment seamless. Learn how to integrate this approach in our guide on Amazon Buy With Prime.

Why Ads Offer a Better ROI Than Promotions

Relying solely on promotions to boost sales is becoming increasingly costly, making a strong advertising strategy essential for maintaining profitability. Amazon DSP allows brands to retarget high-intent shoppers who have viewed a product but haven’t purchased, ensuring they return to complete the sale, without requiring a price reduction. In parallel, Sponsored Products and Sponsored Brands help sellers secure top placement in search results, keeping key ASINs visible without resorting to discounting.

A full-funnel advertising approach combines multiple ad types (display ads, video ads, and search ads) to create a continuous customer journey. Display ads build brand awareness, video ads capture engagement, and search ads drive conversions at the moment of purchase intent. This multi-layered strategy ensures that brands remain competitive, maximize sales, and protect margins, even as Amazon’s promotional fees continue to rise.

Case Study: Using Ads and Price Discounts for Higher Profitability instead of Coupons

With Amazon’s 2025 fee changes, running promotions is now more expensive and less predictable. Our team avoids this by applying price discounts for our client in the home goods brand category.

Rather than relying on Coupons, our team implemented a 10% price discount instead. This automatically triggered Amazon’s “Limited Time Deal” badge at no extra cost, allowing the brand to maintain strong visibility without paying additional promotional fees. To further drive conversions, we allocated their budget to Amazon Ads, using Sponsored Products, Sponsored Brands, and DSP retargeting to attract high-intent shoppers.

By focusing on a combination of strategic discounts and targeted advertising, the brand has been able to sustain sales while keeping costs predictable, long before Amazon’s new fee structure was even announced.

Best Strategies to Stay Profitable in 2025

1. Replace Coupons with Price Discounts + Targeted Ad Support

Coupons will soon cost $5 + 2.5% of attributed sales—making them a margin killer for many SKUs. Instead:

- Use 5–10% Price Discounts to trigger Amazon’s “Limited Time Deal” badge.

- Pair with Sponsored Product Top-of-Search placement to maintain visibility.

- Layer Sponsored Brand Video to communicate value without needing deeper discounts.

Why it works: The “Limited Time Deal” badge still drives urgency, and targeted ads push qualified traffic without the per-redemption cost of Coupons.

2. Adopt a Tiered Promotion Strategy Based on Product Maturity

Not every product needs a full-blown deal:

- New products: Use Prime Exclusive Discounts + Sponsored Display Audiences to gain traction. Skip Coupons and test 7-day Best Deals only after validating conversion rates.

- Mature products: Shift to always-on Sponsored Products, and apply price discounts or bundles during peak periods to defend market share without overspending.

- High-velocity SKUs: Avoid percentage-of-sale promos entirely. Invest in branded keyword conquesting to protect your turf and maintain efficiency.

Why it works: Not all SKUs should be treated equally. A lifecycle-based approach ensures you’re scaling profitably, not just pushing volume.

3. Run Micro-Deals to Contain Costs and Test Impact

Instead of week-long Best Deals with uncapped fees:

- Run 1–2 day Lightning Deals during non-peak windows to test baseline lift.

- Use ASIN-level tracking to isolate incrementality.

- Immediately follow up with retargeting via Amazon DSP to capture lingering intent.

Why it works: You minimize risk exposure while learning how different promos impact your funnel. Shorter runs = lower cost ceiling.

4. Leverage Amazon DSP for Mid- to Lower-Funnel Efficiency

With rising promo costs, DSP becomes a cost-effective engine when deployed smartly:

- Retarget coupon clippers and deal page visitors who didn’t convert—without paying per redemption.

- Build custom audiences from your past deal participants and upsell post-event.

- Use lookback windows of 7–30 days to tailor messaging cadence (urgency vs. reminder).

Why it works: DSP gives you control over frequency, audience, and messaging—without the volatile costs of new promotion structures.

5. Track True Promo ROI with Blended Metrics

Too many brands look at topline deal sales and ignore what it cost to get there. Instead:

- Evaluate total promo cost per incremental unit sold, factoring in:

- Promotion fee

- Discounted revenue

- Associated ad spend

- Cross-reference with organic sales lift post-promotion to measure halo effect.

Why it works: With new variable fees, understanding the true cost of a promotion is non-negotiable. This approach helps you stop chasing vanity sales and start scaling profitably.

Understanding the impact of promotions and advertising requires the right tools. Sellers who use data-driven insights can better allocate budgets and maximize profitability. Check out our list of free Amazon seller tools to help analyze ad performance, track sales, and refine your strategy.

6. Capitalize on Peak Events with Fixed Fee Deals + Aggressive Ad Boosting

Since fees remain fixed for Prime Day, Black Friday, and Cyber Monday:

- Prioritize your highest-converting SKUs for Lightning or Best Deals during these windows.

- Stack with aggressive Sponsored Products Top-of-Search and DSP retargeting during event windows.

- Use Budget Rules to auto-increase daily budgets based on performance thresholds.

Why it works: Peak events give you fee predictability. Combine that with smart ad automation and you maximize profitable scale.

What Sellers Should Do Next

Amazon’s 2025 fee changes are a clear signal: sellers need to become more strategic with how they run promotions and allocate ad budgets. Relying on blanket deals and coupons is no longer sustainable—especially as costs scale with performance. Instead, sellers should:

- Prioritize price discounts over coupons to avoid steep per-unit fees

- Use short, controlled promotions to test impact before committing to longer runs

- Shift budget toward Amazon Ads and DSP to maintain visibility without giving up margin

- Focus on profitability, not just topline sales, by tracking true ROI on every promo

Now is the time to reassess your approach. Our team is already helping brands adapt their strategies ahead of the June 2 rollout—balancing performance, efficiency, and margin protection.

Want to see how your current promotions and ad spend stack up? Request our free Amazon Brand Audit, and we’ll show you how to optimize for profitability under the new fee structure. No fluff, just actionable insights.

LET’S DISCOVER WHAT’S POSSIBLE FOR YOUR BRAND

We’re here to listen and uncover opportunities tailored to your unique goals.

Fill out the form to get started, and you’ll walk away with real insights and actionable recommendations—whether we work together or not.

- HANDS-ON LEADERSHIP

- AWARD-WINNING PARTNERSHIPS

- CUSTOM-BUILT SOLUTIONS