Premium Home Brand Boosted Ad Sales by 18% Without More Spend

Overview

In a category where aesthetics matter as much as performance, this premium home décor brand has carved out a loyal following with stylish products that marry form and function. Competing at the intersection of design, utility, and premium pricing, they’ve turned a traditionally slow-moving category into a fast-scaling eCommerce success story.

Before partnering with Incrementum, the brand had established a strong identity and customer base. However, their Amazon channel wasn’t reflecting their true potential. They were ready to scale, but needed a performance partner who could help them maximize visibility, sharpen their paid media strategy, and convert attention into lasting growth.

With a targeted Prime Big Deal Days 2025 strategy, this brand didn’t just drive record sales; they improved efficiency, increased organic lift, and saw a meaningful boost in conversion rates. Their story shows what’s possible when great product-market fit meets a data-driven retail media engine.

The Challenge

The Approach

DESIGNED FOR IMPACT

We rebuilt the brand’s Prime Big Deal Days strategy from the ground up, prioritizing high-intent placements across both branded and non-branded terms. We leaned into best-selling SKUs with strong discount velocity and updated creative to highlight savings clearly and consistently. Campaigns were segmented by product type, price tier, and keyword match intent to ensure budget efficiency and clear performance read-through.

We also refreshed Sponsored Brands creative from Store Spotlight to Product Collection ads, allowing deal badging and top-performing ASINs to take center stage. The goal: visibility where it mattered, and relevance that converted.

STRATEGY IN MOTION

Mid-flight, we monitored pacing and performance daily, using real-time signals to reallocate budget, adjust bids, and shift placements on high-competition terms like “washable”. On Day 2, increased investment in Top of Search and ROS placements paid off: conversion rates climbed, and ACoS dropped nearly 8 points.

We also maintained over 80% Brand Impression Share to ensure the brand stayed dominant during the event. Competitive conquesting strategies were deployed with Sponsored Display and SD product targeting, focusing on rivals with lower ratings or higher prices.

FULL-FUNNEL + CREATIVE ROTATION

To round out the approach, DSP was used both pre-event to warm audiences and during the event to re-engage high-intent shoppers. Seasonal creative headlines were A/B tested across high-traffic keywords, with value-forward messaging that outperformed more generic brand lines. The combination of aggressive targeting, offer clarity, and full-funnel retargeting helped push results beyond just paid sales, lifting organic orders and total market share.

Our Results

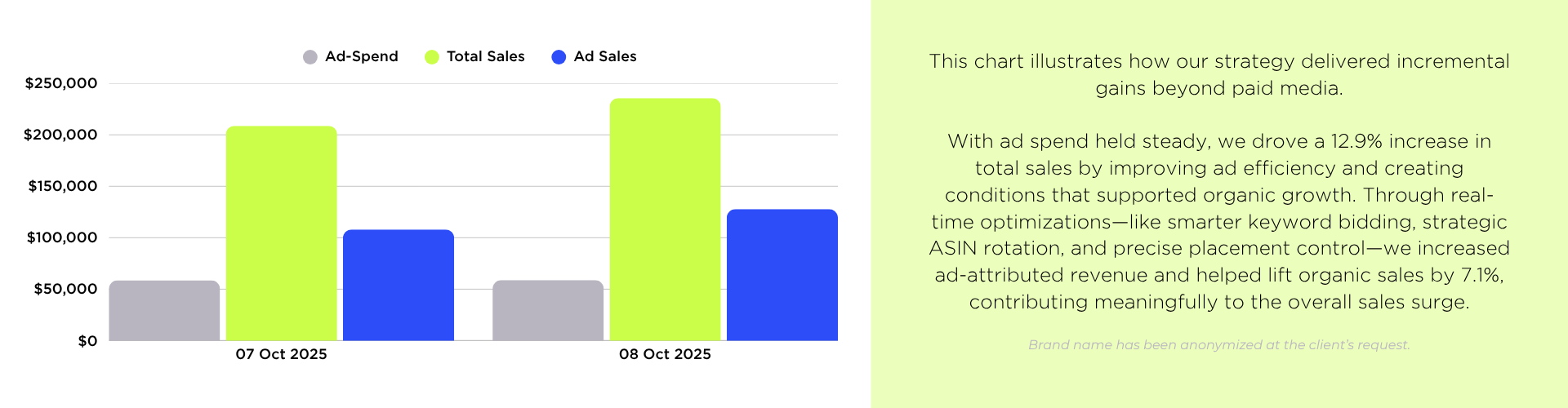

+12.9% Sales Lift during PBDD, with flat ad spend

ACoS Improved from 54.27% → 45.99%, while ad sales grew 18.3%

Organic Sales +7.1%, showing strong halo effect

Conversion Rate Up from 2.04% to 2.49%

80%+ Brand Impression Share held across key placements