How We Rebuilt Demand to Restore Profitable Growth in Premium Apparel

Overview

This case study covers a premium adaptive apparel brand with patented closure technology designed for individuals with mobility challenges. While the brand had strong DTC foundations, its Amazon presence was underdeveloped: listings were live but minimally optimized, advertising was generic, and the product was positioned inside highly competitive apparel categories where its functional advantage wasn’t immediately visible.

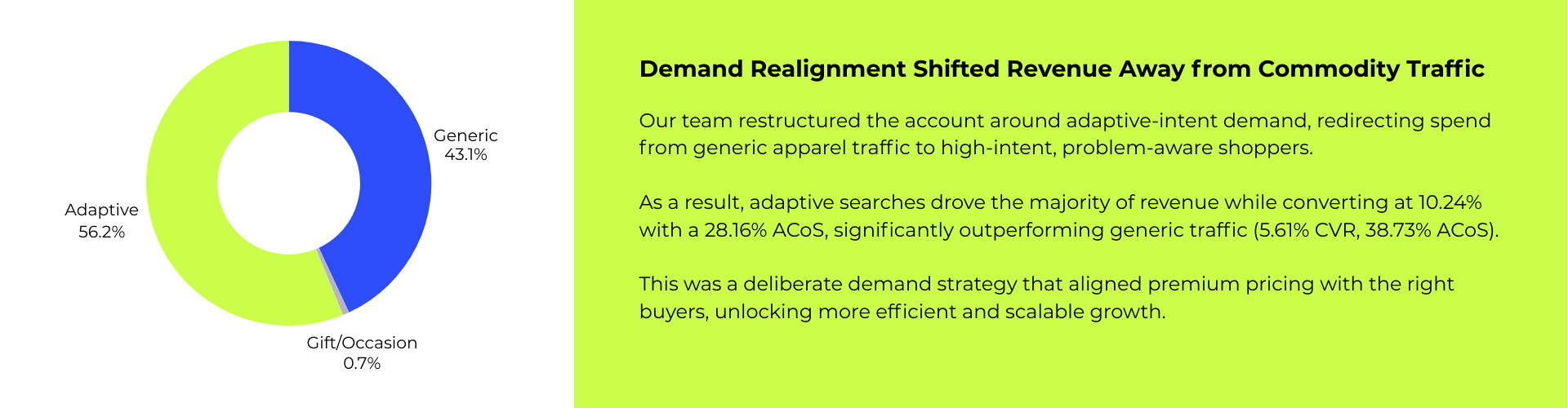

Our team identified that the issue wasn’t demand; it was misalignment. The product was competing like standard apparel, despite serving a high-intent adaptive audience. To unlock scalable growth, we rebuilt the marketplace system around use-case intent, clearer benefit signaling, and structured demand capture, aligning premium pricing with the right buyers instead of broad, low-intent traffic.

The Challenge

Despite operating in a high-intent adaptive apparel niche, the brand faced structural positioning and marketplace constraints that limited scalable growth on Amazon:

-

Premium pricing inside a generic apparel category, forcing an adaptive product to compete against lower-cost, mass-market alternatives

-

Invisible functional differentiation, where the patented closure technology was not immediately clear in search results or main images

-

Generic, broad keyword targeting, attracting low-intent traffic and diluting performance signals

-

Category misalignment, reducing discoverability among mobility-focused and adaptive shoppers

-

Underdeveloped marketplace infrastructure, with minimal A+ content, brand store strategy, and unlayered campaign structure

Together, these dynamics created a system where increased ad spend failed to compound efficiently, primarily because the account was competing for broad apparel demand instead of capturing adaptive-intent buyers.

The Approach

Intent Repositioning & Demand Realignment

We shifted the account away from broad apparel competition and rebuilt targeting around adaptive-intent demand. Instead of prioritizing generic apparel traffic, campaigns were structured around use-case categories such as mobility support. Backend indexing and title refinements reinforced this repositioning, ensuring the algorithm received clearer signals about who the product was actually for. This mattered because premium pricing only works when paired with high-intent buyers. By narrowing traffic to functional need states, we aligned acquisition with purchase readiness rather than passive browsing.

Marketplace Signal Rebuild (Creative + Conversion Infrastructure)

The patented closure technology was not visually obvious, so we rebuilt the conversion layer to communicate value immediately. Main images were updated to highlight the differentiated feature, video placements were deployed to demonstrate functionality, and A+ content and Brand Store architecture were redesigned around independence, ease of use, and gifting context. This transformed the listing from “standard apparel” into “problem-solving apparel,” increasing click-through rate and conversion simultaneously.

Structured Niche Expansion & Harvesting

We introduced controlled expansion campaigns across adaptive sub-niches using broad match discovery, product detail page targeting, and systematic search term harvesting. Instead of scaling aggressively into generic volume, we tested and validated pockets of profitable demand before increasing spend. This created a compounding discovery loop: identifying new high-intent terms without diluting efficiency.

Seasonal Positioning & Demand Capture Sequencing

Recognizing the product’s giftability, we aligned brand store themes, creative, and Sponsored Brand placements with Q4 seasonal intent. Sponsored Brands Video and Sponsored Products video placements were layered to educate before conversion, capturing demand during peak buying periods. By sequencing education and capture, we maximized peak-period efficiency while reinforcing brand positioning for long-term scalability.

Our Results

High-intent revenue unlocked in Q4, with December emerging as a breakout month driven by adaptive-intent targeting and gift-season positioning

Conversion rate and CTR materially improved after repositioning creative and clarifying the patented closure benefit at first glance

Profitable niche expansion established, with adaptive, mobility, and dexterity-related search terms becoming consistent order drivers

Video-led placements increased engagement and efficiency, reinforcing the value proposition where static imagery alone fell short

A structured demand capture system built, shifting the account from generic apparel competition to repeatable, high-intent acquisition