Retail Media

Retail Media Showdown: A Stores vs. C Stores in the Digital Out of Home Advertising Landscape

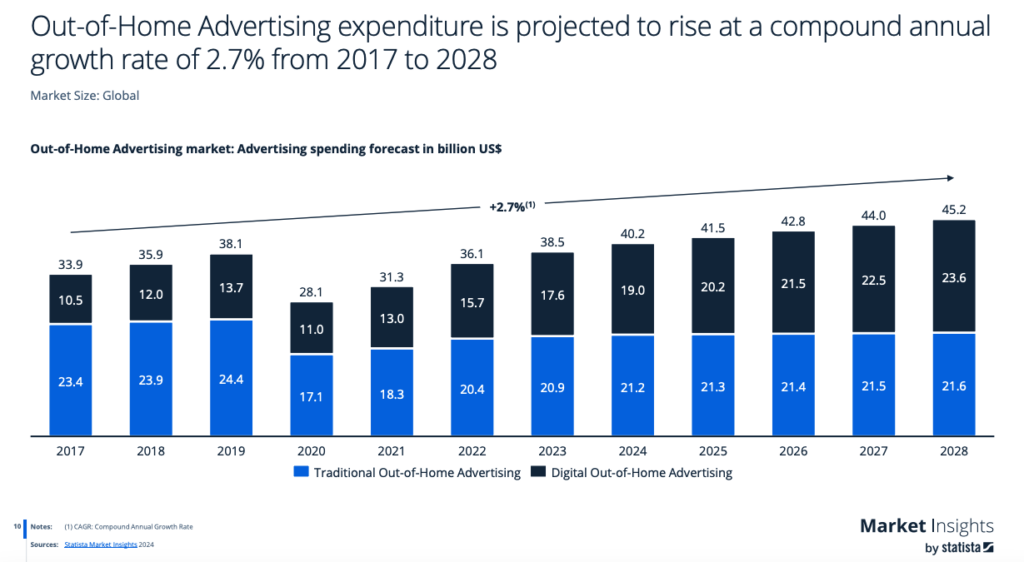

In recent years, there has been a remarkable shift in the out of home advertising landscape. Traditional billboards and signage are being rapidly replaced by their digital counterparts. In fact, it is estimated that nearly 100% of out of home advertising growth will come from Digital Out of Home (DOOH) in the next four years.

Learn How to Make Listings That Convert in 2025!

Read our step-by-step guide on how to optimize your listings using Rufus AI insights. Sign up for our newsletter and get your copy for free!

Show me how

The Rise of Digital Out of Home Advertising

Unlike traditional static billboards, DOOH offers dynamic content that can be updated in real-time, allowing advertisers to deliver targeted messages to specific audiences. With the proliferation of digital screens in cities, airports, shopping centers, and transportation hubs, advertisers are capitalizing on the opportunities presented by this new medium. As an Amazon advertising specialist whose career began when the term “protein powder” cost $0.40 on Amazon, I’ve witnessed the launch of many of Amazon’s innovative ad solutions over the years. In essence, I could safely assume that if Google had the feature 5 years ago, it was likely on Amazon’s roadmap in the coming 1-2 years. Digital out of home, however, took me by surprise.

I was elated when Amazon launched sponsored display capabilities out of home placements in Whole Foods stores back in 2022. Most advertisers heard the announcement and immediately moved on. Measuring ROI of DOOH campaigns is nearly impossible without AMC (this was still in the very early days of AMC), and sponsored ads lower down the funnel had plenty of room for more investment anyways. Advertisers and brands needed a stronger case to support the recommendation or activation of this new ad type, despite Amazon’s profuse exchange of case studies showing high conversion and branded search volume. I agree with these concerns, but I don’t think this opportunity is one that should be overlooked so quickly.

I believe that the issue lies inherently in the retail locations that Amazon chose to start with. Whole foods is not the best place to be activating these ads if the brand paying for the activation is highly concerned with ROI. Give me the name of one brand who isn’t laser focused on digital ROI right now and I’ll pay for your next campaign myself.

C-stores are where it’s at… or where it’s about to be.

C-stores are the future of Digital-Out-Of-Home Ads

Consider your A, B, and C store strategies. The assumption made is that A stores – being the highest traffic locations – are the best fit for digital out of home ads. Because there are so many loyal eyes crossing paths with these ads, the ROI is better in an A store than it would be anywhere else. This couldn’t be further from the truth and I have several datapoints to support this claim.

Inherently, products in convenience stores are offered in smaller packages compared to those in grocery or mass retail outlets. This feature is appealing to Consumer Packaged Goods (CPG) advertisers seeking to trial new products before fully scaling up their packaging and distribution efforts. A survey conducted by NCSolutions highlights that 71% of consumers report discovering new products and brands in convenience stores more frequently than in any other retail setting.

Furthermore:

- C-store shoppers seek convenience and speed. In contrast, grocery shoppers are likely to carry out planned, bulk purchases. When decision making is sped up, this is an excellent time to convert new-to-brand audiences.

- New product attention is not as competitive in a C-store. C-stores typically have a limited selection, focusing on high-turnover items, whereas grocery stores offer a wide range of products.

- You might get information from a single customer in a grocery store 1x per week whereas with C stores, you’ll get purchase data 2-4x that same week. Thanks to their high volume of transactions, convenience stores benefit from a quick data refresh rate, providing up-to-date insights into consumer behavior. This stands in stark contrast to the more consistent, yet less frequently updated, consumer data from grocery stores.

- 50% of U.S. citizens live within 2 miles of a 7-eleven. This presents an opportunity for innovative geofencing and location based campaigns to drive relevant and timely brand exposure.

C-store DOOH is growing fast.

OXXO, Latin America’s largest retail chain with over 20,000 outlets, has partnered with Intouch.com in a groundbreaking, multi-year agreement to forge Mexico’s most extensive retail media network. This collaboration will see the deployment of two 43” screens in over 1,000 stores throughout 2023, with ambitions to expand to over 7,000 stores in the foreseeable future. This initiative is set to revolutionize customer experiences by leveraging artificial intelligence for delivering timely, relevant, and precisely targeted in-store communications, offering unparalleled advertising opportunities for Consumer Packaged Goods (CPG) brands right at the point of sale.

This ambitious digital out-of-home advertising venture is not just about enhancing in-store communication; it aims to fundamentally transform the retail landscape by offering CPG brands direct access to consumers at the critical moment of purchase decision-making. Tim Arits, CEO of Intouch.com, emphasizes that despite historical challenges in retail media business case adoption, their technology unlocks vast opportunities for both retailers and brands to improve communication with in-store shoppers, tapping into the significant segment where over 90% of purchases occur. The Intouch.com platform’s ability to target advertisements based on location, consumer profiles, and even weather conditions, coupled with a broader strategy to digitize the shopping experience, promises to enrich customer engagement, deepen insights into purchasing behavior, and ultimately optimize the in-store journey.

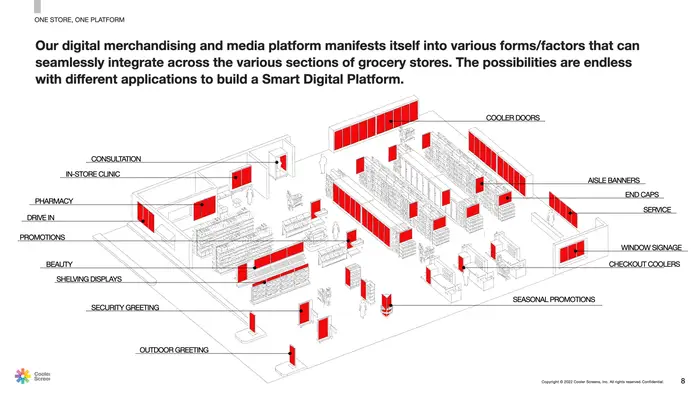

The placements available with ad tech providers like Coolers is truly incredible. The image below shows a breakdown of the placements available in their current roadmap. The Coolers website also has an amazing immersive walk through of this experience. Recently, a nationwide c-store (I assume this is none other than 7-eleven) partnered with Cooler Screens to use in-store digital smart screens to promote a seasonal contest for loyalty members who purchased Coca-Cola beverages. According to Jefferey Bustos of IAB, the campaign drove a 4.1% incremental sales lift for Coca-Cola products while at the same time rewarding loyalty customers and making it easy for new member sign-ups.

This technology has a long way to go. Walgreens former CEO runs the coolers startup, and was involved in a lawsuit back in October regarding the efficacy of the technology. According to the lawsuit, the doors’ digital screens regularly froze or went dark, preventing customers from seeing what was available inside, and some even sparked and caught fire, according to the court documents. The screens also often showed the wrong products or prices, or didn’t show when products were out of stock, according to the documents.

None the less, this opportunity is still ripe for innovation and I believe that a partnership between Amazon, Coolers, and 7-eleven isn’t far.

In late 2022, 7-Eleven Inc. launched the first c-store RMN, Gulp Media Network (80 million loyalty members). With more than 12,800 U.S .stores, 7-Eleven’s geographic reach is larger than Walmart, Target and Kroger combined. The company has stated that the ultimate focus for the network is to drive people to brick-and-mortar stores.

One final thought to leave you with – this strategy is one to consider if your CPG brand is struggling to challenge a saturated category. Keep reading and I’ll explain why this might make sense to consider for H2 2024 if your brand is consumable. Take a look at how Jeffery Bustos of IAB recommends brands differentiate between C-store DOOH and A-store DOOH strategies.

Does DOOH make sense fiscally for challenger brands?

Marketers are becoming incredibly concerned with the measurability of advertising efforts as complexity continues to grow. One of the most common questions we come across is “upper funnel is hard to measure, and often ineffective. Does it even make sense for me to run X awareness campaign?”. Measuring the impact of these ads, and omnichannel purchase behavior is easier than ever with AMC. With the advancement of tools like AMC however, touchpoints are incredibly easy to connect across in-store and online channels. In this case however, our answer depends on the category the brand is challenging. If the brand was challenging a category like “dog collars”, our answer would most likely veer towards a more sponsored-ads-centric recommendation. If the brand was challenging a saturated CPG category however, a c-store DOOH might be just the solution to drive more brand awareness in a measurable, and impactful way.

Let’s use a challenger brand in the powdered hydration pack niche for example.

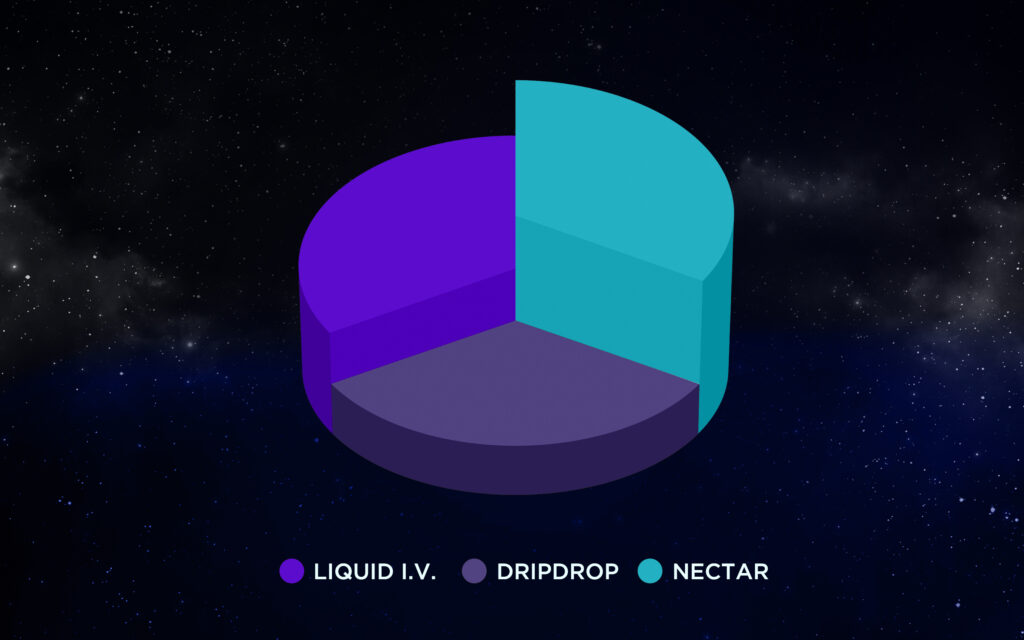

Nectar is a powdered hydration pack brand challenging brands like Gatorade and Liquid I.V. in 2024. The only problem – this subcategory is nearing oligopoly status. Nectar owns a mere 1.1% clickshare of the hydration pack niche.

Take a look at these snapshots from our audit team:

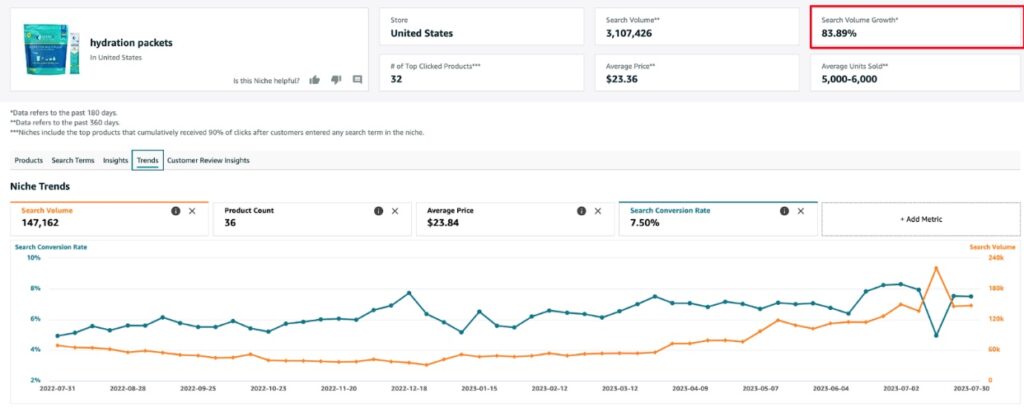

Demand for this niche has nearly doubled since 2022. This is a sign that while clickshare is continuing to fragment, demand is growing steadily.

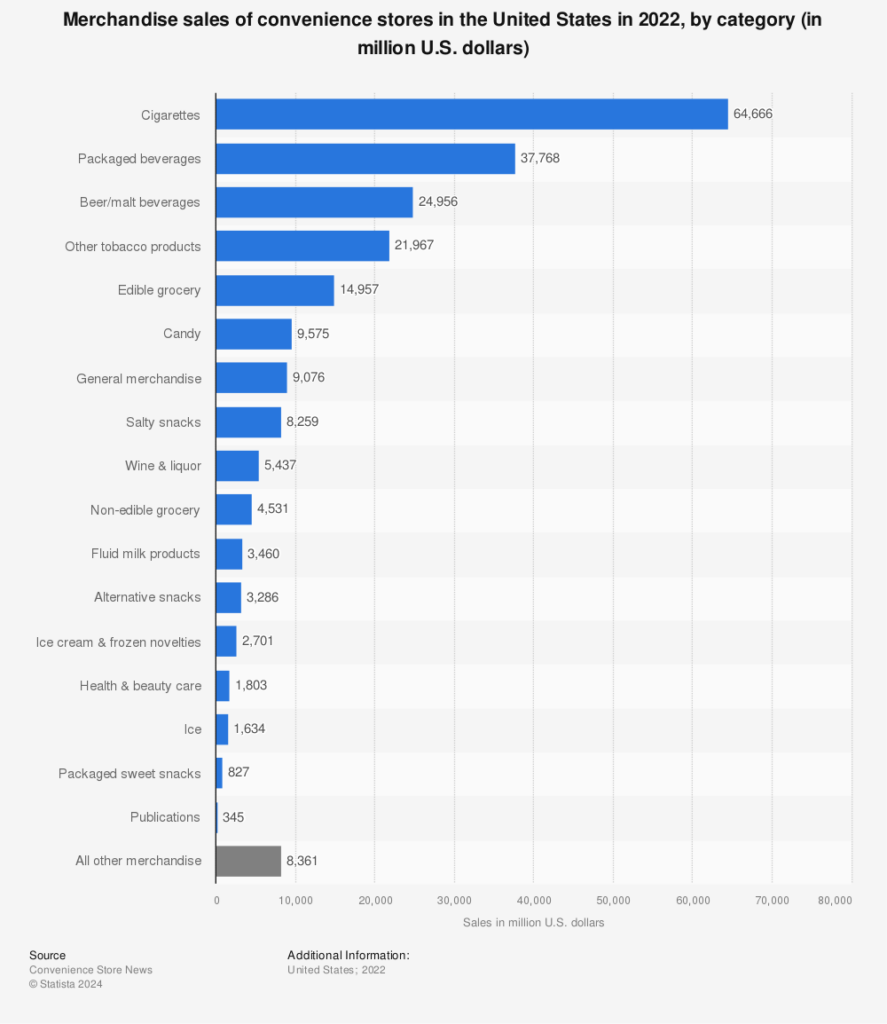

The question then becomes: Where do consumers discover sports drinks?

According to the chart shown here, discovery happens in C-stores. Next to cigarettes, drinks are the most frequently purchased item in your average C-store.

Nectar’s 3 month C-store DOOH activation might look something like this:

- In-store radio ads | $15K

- Gas Kiosk Sponsored Video | $20K

- Cooler Screens Placements, prioritizing the water section | $65K

C-store Digital-Out-Of-Home ads are the next big opportunity for brands like Nectar. Challengers looking to snag visibility in a long standing subcategory, without sacrificing the ability to truly measure impact.

In Conclusion

The future of out of home advertising is undeniably digital. Nearly 100% of growth in the next four years is expected to come from Digital Out of Home (DOOH), representing a rapid evolution in the advertising landscape. This shift presents a significant opportunity for advertisers to engage with specific audiences through dynamic content and real-time targeting.

C-stores are emerging as the next frontier for DOOH advertising, offering unique advantages such as high turnover and convenience-driven consumer behavior. Despite early challenges with technology reliability, partnerships between retailers, technology providers, and advertisers are driving innovation in the DOOH space.

In summary, the rise of digital out of home advertising, particularly in C-stores, signals a paradigm shift in the way brands connect with consumers in physical spaces. By embracing this growing opportunity and leveraging the power of digital technology, advertisers can unlock new levels of engagement and drive measurable results in the ever-changing media landscape.

To get started with your own DOOH ad campaign, connect with our team.

LET’S DISCOVER WHAT’S POSSIBLE FOR YOUR BRAND

We’re here to listen and uncover opportunities tailored to your unique goals.

Fill out the form to get started, and you’ll walk away with real insights and actionable recommendations—whether we work together or not.

- HANDS-ON LEADERSHIP

- AWARD-WINNING PARTNERSHIPS

- CUSTOM-BUILT SOLUTIONS