Amazon Advertising

How to Strategize for Multi-Day Amazon Sales Events like Amazon Prime Day 2025

In 2025, Amazon expanded Prime Day to four days to give customers “more time to shop and save.” This decision, according to Amazon VP Jamil Ghani, was in response to what Prime members asked for, allowing shoppers more flexibility around deals and extended access to offers. But according to Bloomberg, sales fell close to 14% in the first four hours compared to last year. It’s not a perfect year-over-year comparison, though, because customer behavior might be different given the longer sales event.

Learn How to Make Listings That Convert in 2025!

Read our step-by-step guide on how to optimize your listings using Rufus AI insights. Sign up for our newsletter and get your copy for free!

Show me howStill, it raises the question: has urgency been lost? Our CEO Liran Hirschkorn suggests exactly that: “It’s like making Black Friday last a whole week. Nobody rushes when the deal’s still there tomorrow.”

But that’s where strategy steps in. When urgency fades, precision, timing, and team collaboration become the new performance edge. Here’s how we approached the 4-day Prime Day, and how this same framework applies to any extended ecommerce event:

1. Anticipate a Longer Purchase Window

While the headline read “Prime Day starts July 8,” the reality was different. For our advertising team, Prime Day began days earlier.

In the lead-up to the event, shoppers were already researching, adding to cart, and comparing prices, not only on Amazon but also across Walmart, TikTok Shop, and other platforms. This window-shopping behavior meant that early advertising impressions were critical to stay top of mind.

For ASINs with Prime Day deals, we implemented around a 20% increase in ad budgets several days before the event began. This allowed us to capture high-intent traffic during the research phase and increase the likelihood of those shoppers converting once the discounts went live. These campaigns helped build momentum and identify early signals on which products were generating interest.

At the same time, we pulled back spend on non-deal ASINs. Based on prior experience and insights from Liran and our Director of Advertising Mansour Norouzi, we knew these products were less likely to convert before the event. Scaling back prevented inefficient ad spend and reduced the risk of shoppers getting frustrated when clicking on a product only to find no Prime Day discount.

This pre-event ramp set us up to hit Day 1 at full force. Because we had already built audience interest and minimized wasted budget, we entered the peak with clarity on where to invest more, which creative was performing best, and how to structure our day-one bidding strategy for maximum impact.

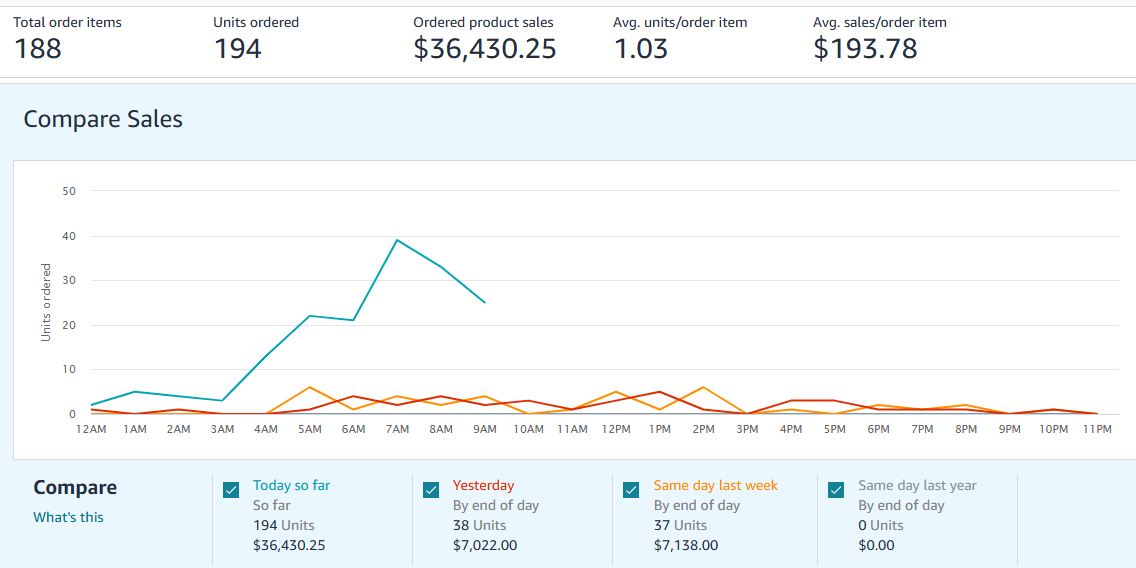

Proof in the numbers: Our strategic ramp-up delivered a 5X+ sales lift on Day 1 of Amazon Prime Day 2025 compared to the previous day: $36K by 9 AM vs. $7K all day yesterday. Strong pre-event planning + early budget acceleration = performance momentum when it counts

2. Scale Aggressively on Day 1 While Monitoring Closely

Despite the shift to a four-day Prime Day format, our strategy remained anchored around one assumption: Day 1 would be the strongest. And it was.

Liran and Mansour both predicted this. As Liran put it, “My prediction is that Day 1, as usual, will have the highest increase.” Backed by years of client performance data, we approached Day 1 with intensity and precision.

Budgets were set to two to three times their daily average for ASINs with active deals. We increased bids across Sponsored Products and Sponsored Brands, especially for top-of-search placements where conversion rates tend to spike. Performance was monitored in real-time, with midday check-ins to catch early pacing issues or underdelivery.

Key to this approach was campaign segmentation. Products with deals got the lion’s share of budget and attention. Non-deal ASINs were deprioritized unless they supported brand defense or halo sales. By keeping these campaigns running with lean but deliberate budgets, we maintained presence without overinvesting.

We also made sure retargeting and branded search campaigns were fully funded. Traffic from pre-Prime Day days began to bounce back, and shoppers who had seen our products during research phases were now ready to convert. Our campaigns were ready to meet that demand with visibility, relevance, and speed.

Day 1 was all about visibility and execution. When you get it right, it sets the pace for everything that follows.

3. Segment Campaigns Based on Deal Participation

A core pillar of our extended-event strategy is what we call the “two-bucket approach”: a disciplined segmentation based on whether a product is participating in a promotional deal.

For ASINs with active deals, we doubled down. These products received aggressive increases in budget and bids, often two to three times their daily norm. Sponsored Products and Sponsored Brands were optimized for top-of-search real estate, branded search campaigns captured demand from brand-aware shoppers, and retargeting was fully leveraged to close the loop on interested browsers.

Non-deal ASINs followed a more selective playbook. Unless a product played a clear role in halo sales or brand defense, we reduced bids or paused campaigns altogether. This minimized waste from clicks unlikely to convert, especially in high-competition moments when shoppers were laser-focused on discounts.

This segmentation enabled a clean, performance-first allocation strategy. We scaled impact where it mattered most and shielded the rest of the catalog from inefficiencies, preserving both ROAS and strategic control throughout the event.

4. Use Real-Time Data to Guide Daily Budget Shifts

With extended sales events, fixed plans fall short. Our approach relied on agile, data-driven decision-making, using live campaign performance to guide daily shifts.

From the moment the event began, we activated retargeting, capturing high-intent audiences who browsed or added to cart but didn’t convert. Sponsored Display and Amazon DSP played a critical role in re-engaging these shoppers, especially in categories with longer consideration cycles.

We also reinforced halo ASINs and branded search visibility. As customers circled back on later days, familiar brands had the edge. Sponsored Products and Sponsored Brands helped convert lingering interest into sales.

Bid and budget decisions were informed by campaign pacing, placement efficiency, and evolving audience behavior. Rather than spending uniformly, we moved dynamically, scaling up where performance justified it and pulling back where it didn’t.

5. Activate Retargeting and Branded Search for Recapture

Once peak demand starts to taper, strategic recapture becomes essential. This is where retargeting and branded search play a critical role in closing the loop with high-intent shoppers.

Our team executes:

- Immediate retargeting activation via Sponsored Display and DSP to re-engage visitors who browsed or added to cart but didn’t convert.

- Support for halo ASINs and branded search to stay top of mind as customers return to complete their purchase journey.

- Ongoing bid optimization based on live metrics like CPC, CTR, and conversion rates.

- Agile budget reallocation, shifting spend toward high-performing campaigns and away from under-delivering ones.

- Quick deactivation of underperforming ASINs to free up budget for top performers.

This responsive, data-driven approach ensures no opportunity is left on the table, even after the initial traffic surge fades.

We Win Together: How We Collaborate as a High-Performance Team

Extended sales events demand more than good planning; they demand rapid, informed decisions. At Incrementum Digital, this is where our collaborative team structure becomes a performance multiplier.

When Prime Day (or any major sales window) hits, our entire ads division engages. Slack channels are structured by brand, allowing strategists, senior leads, and leadership to troubleshoot in real time.

- Someone flags a campaign pacing too fast? One of our ad team leads jumps in to analyze historical spend patterns and recommend pacing adjustments.

- Need fresh eyes on a Sponsored Brands creative? Kate jumps in with high-performing creative insights from other accounts and recent A/B tests.

- Looking to streamline operations mid-event or reallocate budget with precision? Brian leverages automation insights and seller ops data to help improve efficiency at scale.

- Want to assess whether to reallocate budget across DSP and Sponsored Products? Mansour or Liran weighs in with macro performance trends and account-level ROAS comparisons.

Every client benefits from a hive of specialized knowledge: DSP experts optimizing audience retargeting, sponsored ads pros refining placement strategy, and data analysts surfacing actionable insights. Our collaborative model eliminates bottlenecks and decentralizes decision-making, so we can pivot fast without sacrificing precision.

The result: tighter control, higher responsiveness, and stronger outcomes, especially when customer behavior shifts daily. Partnering with us means getting more than a rep. You get a coordinated, expert-driven system engineered for performance.

Curious how this works for your brand? Start with a free audit. Let’s make your next sales moment your most efficient one yet.

LET’S DISCOVER WHAT’S POSSIBLE FOR YOUR BRAND

We’re here to listen and uncover opportunities tailored to your unique goals.

Fill out the form to get started, and you’ll walk away with real insights and actionable recommendations—whether we work together or not.

- HANDS-ON LEADERSHIP

- AWARD-WINNING PARTNERSHIPS

- CUSTOM-BUILT SOLUTIONS