Ecommerce Experts

How to Launch a New Product on Amazon Successfully in 2026

Many an Amazon product launch underperforms for a simple reason: key decisions are made too late. Creative is often based on internal assumptions, listings are adjusted after launch, and PPC is expected to compensate before click-through and conversion are proven. The downstream effect is familiar: low CTR, uneven conversion, inefficient spend, and limited organic lift. This was the starting point for The Pre-Launch Playbook, a joint session led by Liran Hirschkorn, Founder & CEO of Incrementum Digital, and Tamar Yaniv, CMO of Intellivy. The session focused on a practical system for validating positioning, creative, and listings before launch or relaunch, so advertising can be used to scale proven fundamentals, not fix them after the fact.

Learn How to Make Listings That Convert in 2025!

Read our step-by-step guide on how to optimize your listings using Rufus AI insights. Sign up for our newsletter and get your copy for free!

Show me how

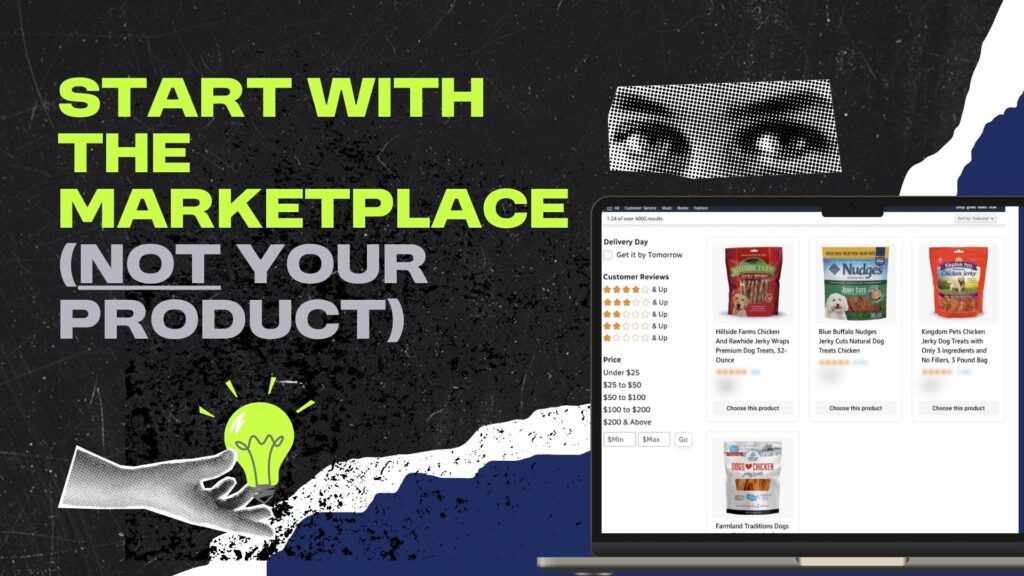

You’re launching into a marketplace, not a vacuum

Every product launch enters an existing competitive environment. On the digital shelf, shoppers evaluate options side by side (often within seconds) across Amazon, Walmart Marketplace, and discovery-driven environments like TikTok Shop.

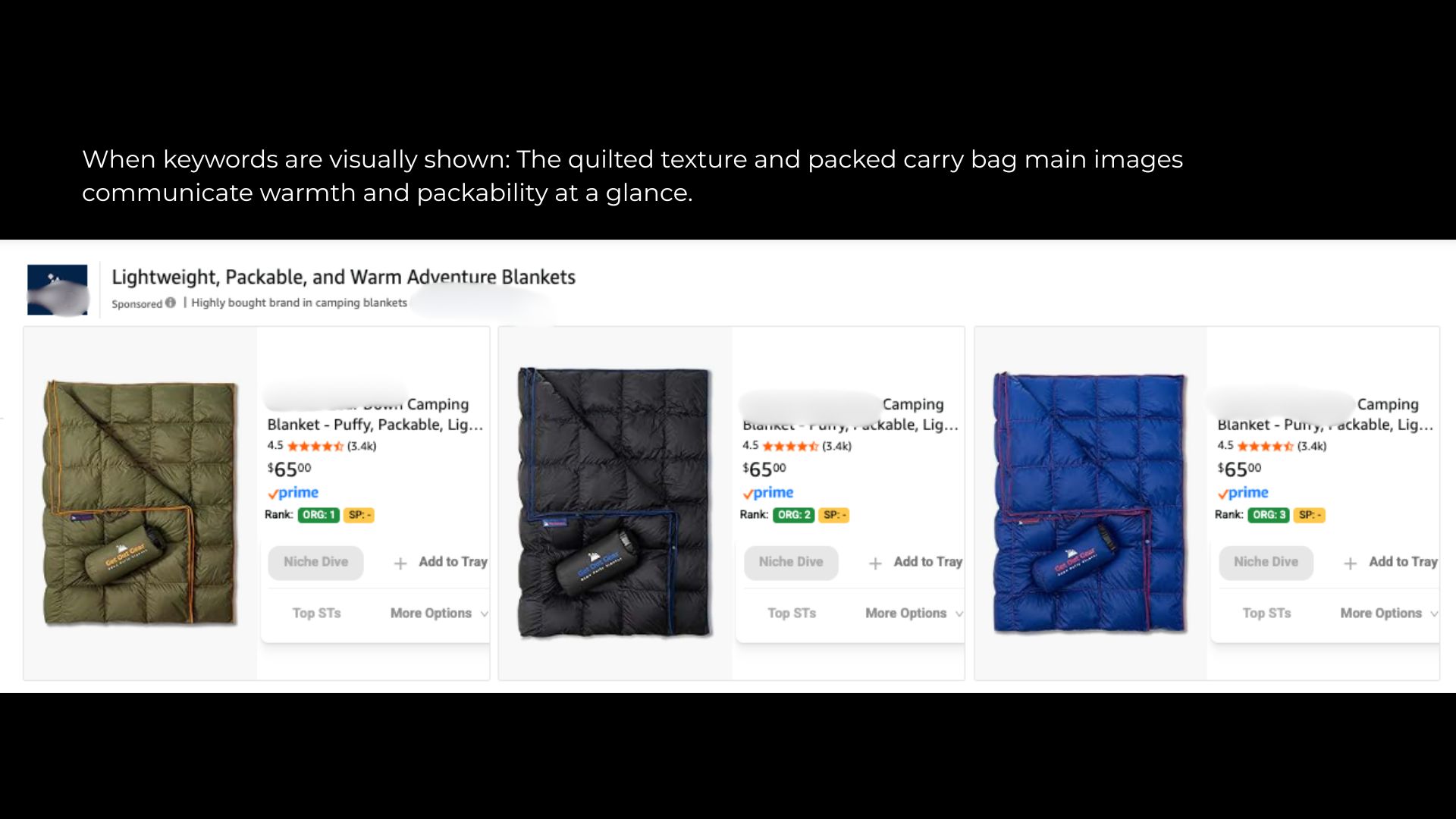

This is where many retail-first decisions start to break down. Packaging and creative designed to perform well on a physical shelf don’t always translate online. Elements like large product windows, subtle branding, or minimal claims may work in-store, but on the digital shelf they often consume valuable main-image real estate without clearly communicating why a shopper should click.

In a crowded category, visibility is earned first through clarity. Shoppers aren’t studying a single product; they’re scanning a grid of alternatives. The job of the main image and primary creative is not to tell the full story, but to stop the scroll and communicate value instantly. If that doesn’t happen, no amount of downstream optimization or ad spend can recover the lost attention.

The Pre-Launch System (high level)

Before launching a product on Amazon, sellers should follow this simple sequencing principle: validate first, then scale. Instead of launching, collecting data slowly, and fixing issues reactively, the system front-loads learning so the right decisions are made before meaningful spend or inventory risk.

Step 1: Validate positioning and the main image before scaling

Before ads or aggressive launches, the focus is on how the product shows up in a competitive grid. Positioning, messaging, and the main image are tested in a realistic marketplace context to understand what actually earns the click — without relying on reviews, ratings, or brand bias.

Step 2: Turn shopper feedback into listing and creative decisions

Validation isn’t theoretical. Real shopper feedback is translated directly into changes across the listing: main image hierarchy, titles, bullets, secondary images, and creative emphasis. Objections are addressed, benefits are clarified, and messaging reflects how shoppers actually think and decide.

Step 3: Use ads to amplify validated demand and accelerate ranking

Once positioning and creative are proven, advertising is used for what it does best: capturing existing demand and driving momentum. With higher click-through and conversion rates already in place, ads become more efficient, organic ranking compounds faster, and scale becomes sustainable instead of fragile.

Part I — Validate before you scale

Start with the marketplace poll (not split tests in isolation)

Validation works best when it reflects how shoppers actually buy. Instead of testing concepts in isolation, the process starts with a marketplace simulation, placing a product directly alongside real competitors and observing how it performs in context.

This approach matters because shoppers don’t evaluate listings in a vacuum. They compare options side by side, scan quickly, and make relative judgments. By building a clear “shopping scenario,” respondents understand what they’re evaluating and can give more realistic, decision-oriented feedback.

To isolate creative effectiveness, reviews and star ratings are intentionally hidden. That removes social proof from the equation and turns the poll into a clean proxy for click-through behavior, a test of whether the main image and positioning are strong enough to earn attention on their own.

Case walkthrough: Hillside Farms jerky wraps (relaunch mindset)

The example used in the session was Hillside Farms jerky wraps, selected not as a brand-new launch, but as a listing with clear upside. The goal wasn’t to start from zero but to identify why an existing product wasn’t capturing as much demand as it could.

One issue surfaced quickly: a digital shelf mismatch. The packaging featured a large product window that works well in physical retail, where shoppers can examine the product up close. On the digital shelf, that same window consumed valuable main-image real estate without clearly communicating benefits or differentiation.

In the initial marketplace poll, the product ranked third. That outcome wasn’t treated as a failure. Instead, it served as a diagnostic baseline, confirming that the product had room to improve and giving direction on what needed to change before any attempt to scale.

Pull insights the right way: AI summary plus hands-on tagging

AI summaries are useful for spotting patterns quickly: common themes, repeated objections, and high-level preferences. They help teams move faster and align on what matters.

But the process doesn’t stop there. Reading individual responses and tagging them manually forces direct exposure to the voice of the customer. This hands-on step makes feedback harder to ignore and easier to translate into decisions.

A simple tagging framework helps organize insights:

- Value cues shoppers respond to immediately

- Objections that slow or block purchase

- Missing information shoppers expect to see

- Trust markers that increase confidence

This structure turns qualitative feedback into something actionable across creative, listings, and messaging.

Objections vs. messaging: don’t lead with the weak point

Validation often surfaces objections: ingredients shoppers question, claims they scrutinize, or attributes that create hesitation. These need to be handled carefully.

The principle is balance. Compliance and honesty come first: ingredients and required information must be accurate and accessible. But that doesn’t mean leading with the most controversial detail in the most prominent place.

Instead, messaging should emphasize the benefits that matter most and naturally overcome hesitation — such as simple ingredients, quality sourcing, or made-in-the-USA cues — while still remaining transparent. The guiding rule is straightforward: answer objections without spotlighting them.

Part II — Iterate creative fast (without expensive design cycles)

Use AI to prototype packaging and main images quickly

One of the biggest shifts in pre-launch validation is how quickly creative can now be produced and tested. AI-generated mockups make it possible to explore multiple packaging and main image concepts in hours, not weeks, without committing to final design work.

The workflow is intentionally lightweight: prototype → poll → refine → polish. Early AI outputs don’t need to be perfect. They only need to be clear enough to test positioning, hierarchy, and message clarity in a competitive context. Once a direction is validated through polling, a designer can take the winning concept the last 10–20% of the way, dramatically reducing cost and rework.

This approach allows teams to validate ideas before inventory is ordered or packaging is locked, shifting creative risk earlier in the process.

What to change first: main image “real estate” strategy

Polling feedback made it clear that the original main image underperformed because it didn’t communicate enough, fast enough. Shoppers described it as plain or outdated and struggled to understand the product’s value at a glance.

When compared side by side with competitors, the difference was obvious. Winning listings used their main image to highlight:

- Clear ingredient callouts

- A simple benefit hierarchy

- Strong visual cues that reinforced quality and trust

Improvements focused on adding immediate clarity: signaling real chicken, calling out ingredient count, reinforcing made-in-the-USA sourcing, and adding lab-tested cues where appropriate. The goal wasn’t to overcrowd the image, but to use the limited space to answer the most important questions before a shopper scrolls past.

Polling like a scientist: replicate, don’t reinvent

Effective testing depends on discipline. Instead of constantly changing variables, the process duplicates the same marketplace poll and modifies only what matters — typically the main image and, when necessary, the title.

This makes results easier to interpret and prevents false conclusions. It also allows teams to stop losing concepts early. If a creative direction clearly underperforms after partial responses, the poll can be halted, revised, and relaunched without waiting for full completion.

An added benefit of replication is visibility into category dynamics. As competitors update their messaging, shopper preferences can shift. Regular testing ensures decisions stay aligned with the current competitive landscape, not last quarter’s assumptions.

Add an “image impact” test (scroll-speed reality check)

To simulate real browsing behavior, an image impact test measures what shoppers retain after extremely short exposures. One group sees the image for a fraction of a second; another sees it for slightly longer.

The insight isn’t what shoppers can understand given time, but what they actually take away while scrolling. Results often reveal which cues land immediately — such as premium positioning or made-in-the-USA signals — and which details go unnoticed.

These findings help refine not only the main image, but also the supporting “wingman” second image. Anything that doesn’t land instantly can be carried into the next image in the stack, preserving clarity without overloading the hero image.

Part III — Turn validation into listings + ads (the scale layer)

Translate poll insights into listing fundamentals

Once validation is complete, the next step is execution. Poll insights should directly inform how the listing is built, starting with the fundamentals that drive both shopper behavior and algorithmic performance.

Titles and bullets should reflect actual shopper intent, not internal assumptions or keyword checklists. In practice, that means prioritizing clarity and meaning over keyword stuffing — especially as platforms like Amazon increasingly rely on semantic understanding rather than exact-match density.

Consumer language matters here. The words shoppers use in feedback often outperform brand-crafted phrasing because they mirror how buyers think, search, and evaluate. That language should show up not just in copy, but in image text and visual callouts as well.

Advertising amplifies demand — it doesn’t invent it

Ads work best when they reinforce something shoppers already respond to. When messaging is validated upfront, paid traffic becomes more efficient because it’s amplifying proven demand rather than testing guesses at scale.

Validated insights can (and should) flow into multiple ad surfaces:

- Sponsored Brand headlines

- Sponsored Brand Video

- Sponsored Display creative

- Storefront messaging

- Secondary images and infographics

When creative, listings, and ads speak the same language, click-through and conversion improve together, and spend works harder as a result.

The ranking flywheel: CTR, CVR, and sales velocity

Organic momentum is driven by a simple flywheel: click-through rate, conversion rate, and sales velocity. Of these, the main image is often the biggest lever because it directly controls CTR — the gateway to everything else.

That said, creative isn’t the only factor. Price, reviews, product quality, and positioning all influence conversion. The goal of ads is not to mask weaknesses, but to create early momentum once fundamentals are in place, allowing organic rank to compound without permanent dependence on paid traffic.

Launch or relaunch campaign structure (practical checklist)

With validation complete, campaign structure becomes much more straightforward:

- Start with high-intent exact match keywords, not just the highest-volume terms

- Use Top of Search placements intentionally to capture stronger CTR

- Run auto campaigns for both discovery and incremental performance — they’ve improved significantly

- Layer in competitor targeting and Sponsored Brand Video for early engagement

- Actively pause low-converting targets that dilute efficiency and slow momentum

At this stage, ads are no longer compensating for uncertainty. They’re accelerating what’s already been proven to work.

Part IV — The 2026 layer: Rufus + AI optimization

Rufus changes the rules: answers, not spam

Rufus represents a meaningful shift in how discovery works on marketplaces. Instead of rewarding dense keyword repetition, it prioritizes clear answers. Natural language now outperforms forced keyword stuffing, especially when it reflects how real shoppers ask questions and evaluate products.

Rufus scans images, reads reviews, and understands concepts, not just terms. That means discoverability is increasingly driven by whether your listing explains the product well, not how aggressively it repeats phrases. The new play isn’t about packing in more keywords; it’s about being discoverable by meaning.

This makes pre-launch validation even more critical. When your messaging is grounded in real shopper language and intent, you’re feeding Rufus the signals it needs to surface your product for the right queries.

Use Rufus as a competitive research tool

More than just a discovery tool, Rufus is also a diagnostic one. You can actively interrogate it by asking questions on your own listings and on competitor listings to see what it can and can’t answer.

This quickly reveals gaps:

- What does Rufus clearly understand about your product?

- Where does it hesitate, generalize, or fail to answer?

- What information competitors are surfacing more effectively?

Those gaps point directly to optimization opportunities. They can be addressed through:

- Image text and infographics that make key attributes explicit

- Clearer titles and bullets that reinforce meaning, not noise

- Review strategy over time, ensuring important attributes are consistently reinforced by customer language

In a Rufus-driven environment, optimization is about teaching it clearly, consistently, and in the language shoppers already use.

Get the Rufus Playbook

Based on our 2025 webinar, this is a concise playbook for winning discoverability that still applies in 2026.

Inside:

- What Rufus actually understands about your product (and why most listings are invisible to it)

- How images, reviews, and copy work together to surface you for the right shoppers

- A pre-scale checklist to identify blind spots before you spend another dollar on ads

Designed for marketplace brands that want faster validation, cleaner launches, and fewer surprises after go-live. Click here to get the Rufus Playbook.

LET’S DISCOVER WHAT’S POSSIBLE FOR YOUR BRAND

We’re here to listen and uncover opportunities tailored to your unique goals.

Fill out the form to get started, and you’ll walk away with real insights and actionable recommendations—whether we work together or not.

- HANDS-ON LEADERSHIP

- AWARD-WINNING PARTNERSHIPS

- CUSTOM-BUILT SOLUTIONS